TSCA Fees for Test Rules

EPA requires payment of fees from manufacturers (including importers) of a chemical that is the subject of a TSCA section 4 test rule. Because the manufacturers and importers of the chemical may not be known, EPA will initiate a process to identify those entities subject to the TSCA fees. This page describes the requirements and processes related to TSCA fees.

- Who pays

- Identifying fee payers

- Fee amounts

- Deadline for fee payments

- How to pay fees

- Timeline

- Refunds

Who Pays

For test rules under TSCA section 4, all domestic manufacturers and importers of the chemical subject to the test rule, including importers of an article containing the chemical, would be subject to the TSCA fee and associated requirements.

Learn more about who must pay TSCA fees.

Identifying Fee Payers

For section 4 test rule activities, EPA will initiate a process to identify manufacturers (including importers) subject to fees, including:

- publication of a preliminary list that identifies manufacturers and importers based on information available to EPA;

- a public comment period (to facilitate self-identification as required by the final rule, certification as a “small business concern,” certification of cessation or no manufacture; and correction of errors); and

- publication of a final list of fee payers.

See also the TSCA Fees final rule at 40 CFR 700.45(b).

The Preliminary List

To develop a preliminary list of manufacturers, EPA uses sources like information collected under the Chemical Data Reporting (CDR) and TSCA Inventory Notification (Active/Inactive) rules; data collected by the Toxics Release Inventory Program; other TSCA reporting notices; and publicly-available information or information submitted to other agencies to which EPA has access.

For test rule activities under TSCA section 4, each preliminary list will be published with the proposed test rule.

Public Comment Period

Publication of a preliminary list coincides with the opening of a public comment period of no less than 30 days. As required in the final rule at 40 CFR 700.45(b), all manufacturers (including importers) of the subject chemical, regardless of whether or not they appear on the preliminary list developed by EPA, must take the following actions during this period:

- Self-identify as a manufacturer/importer subject to the fee obligation, irrespective of whether or not they are listed on the preliminary list;

- Provide certain basic company information to EPA, such as name, address and telephone number for a technical contact; and

- Certify as to whether they qualify as a “small business concern.”

Where appropriate, manufacturers (including importers) of the subject chemical may also take the following actions:

- Certify as to not manufacturing/importing the high-priority chemical in the last five years (and therefore not responsible for the fee); or

- Certify as to having ceased manufacture/import activity for the chemical prior to the cutoff date listed in the final rule at 40 CFR 700.45(b)(6), and certify they won’t re-enter the market for a period of 5 years (and therefore not responsible for the fee)

EPA’s Central Data Exchange (CDX) system is set up to facilitate the required and optional certifications, consistent with the requirements in the fees rule. EPA will use the information collected in CDX to facilitate future communications with and, where appropriate, invoicing for a portion of the TSCA fees.

The public may also submit comments during this time at www.regulations.gov.

The Final List

After considering responses from the manufacturers/importers and other public input, EPA will develop the final lists of responsible fee payers.

For test rule activities under TSCA section 4, each final list will be published with the final test rule.

Fee Amounts

For test rule activities under TSCA section 4, the total fee amount is $35,080. The total fee amount will be shared amongst the manufacturers/importers identified on the final lists. The amount each entity is responsible for will vary depending on the total number of fee payers identified, and the number of entities identified as “small business concerns.” See the final rule at 40 CFR 700.45(f). Entities that meet the criteria for a “small business concern” receive an 80% discount off their respective share of the fee.

Deadline for Fee Payments

For test rule activities under TSCA section 4, fee payments are due within 120 days of the effective date of the test rule.

How to Pay Fees

Fees for TSCA section 4 test rules will be invoiced electronically by EPA. Invoice notices will be populated into the specific user's “Copy of Record” screen in CDX and will contain a button that will initiate the payment process. When an invoice is generated, notification e-mails will be sent to the user's CDX inbox and the e-mail address associated with the relevant CDX account. Payment information will be collected in CDX and then submitted to Pay.gov for processing. Users should not attempt to make payments directly to Pay.gov.

Entities can either pay individually or to join together and form consortia to pay the TSCA fees for these activities. In order to form a consortium, a principal sponsor must notify EPA via CDX that the consortium has formed. The notification must generally occur within 60 days of the publication of the test rule under TSCA section 4. The consortium is responsible for determining how to divide the fee among its constituents and submitting payment to EPA. See the final rule at 40 CFR 700.45(f).

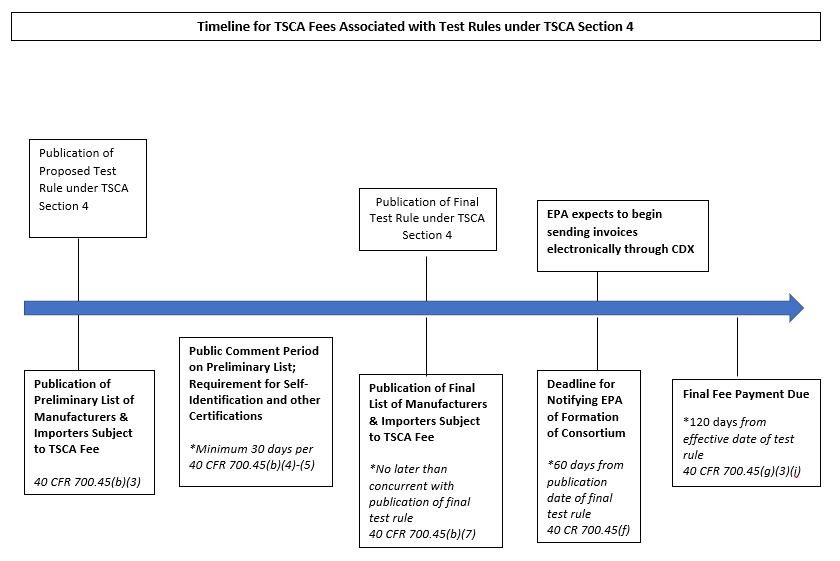

Timeline

Refunds

Refunds are NOT available for fee payments made for test rules under TSCA section 4. See the final rule at 40 CFR 700.45(h) for more information on refunds.