Status of Chlorine Product Availability and Pricing

Last Updated: 5/18/2022

Overview of the Supply Chain of Chlorine Products in the U.S.

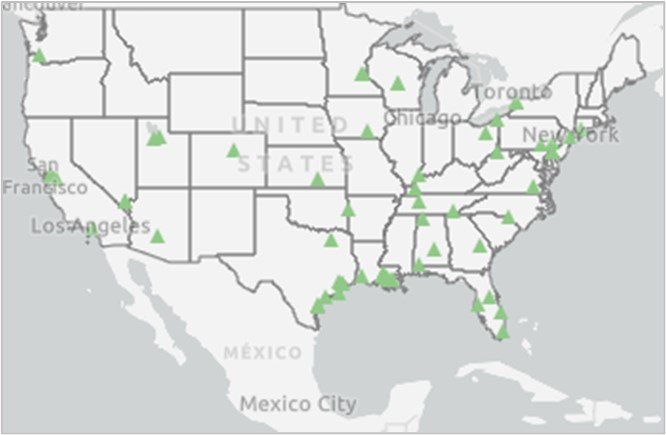

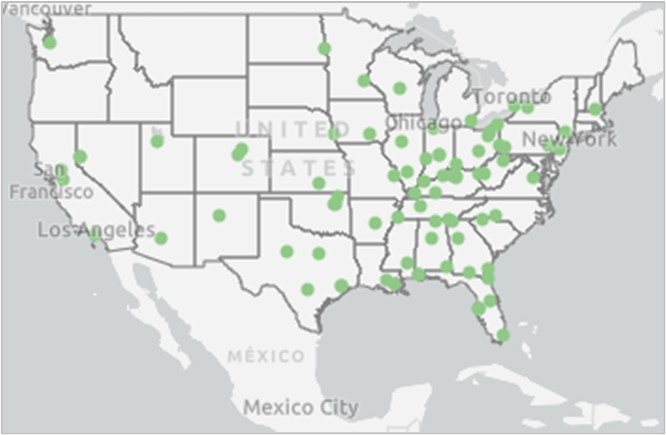

Maps of manufacturer and supplier facilities for chlorine gas and liquid sodium hypochlorite (bleach) in the U.S. are shown in Figures 1 – 4. For chlorine gas, a limited number of manufacturing companies sell their product on the consumer market, so some of the facilities shown in Figure 1 do not provide chlorine to suppliers that service the water and wastewater system sector. For sodium hypochlorite, essentially all manufacturing companies sell their product on the consumer market. Use the Chemical Suppliers and Manufacturers Locator Tool to learn more about manufacturer and supplier facilities for chlorine products and other chemicals used for water and wastewater treatment.

Note that only 5-6% of chlorine products that are produced in the U.S. are used for drinking water or wastewater disinfection.

Issues Impacting Chlorine Availability

Chlorine production capacity in the U.S. experienced an approximate 10% decline (1.2 million tons) in 2021, due primarily to the closure of manufacturing facilities (one OxyChem plant1, three Olin Corporation plants2). Additionally, production at manufacturing facilities has been limited at times due to planned activities (e.g., scheduled maintenance activities) and unexpected events (e.g., fires, power outages, equipment malfunctions, inability to fully staff facilities in response to Covid-19 outbreaks). In some cases, manufacturers have decided to not operate facilities at maximum capacity and/or closed facilities, which has further limited production.

These market conditions have extended lead times for suppliers to purchase chlorine products by as much as 50% (e.g., 14 days to 21 days) and at times these orders are only partially filled. This has resulted in suppliers needing to reduce product allocation for customers in an attempt to keep all critical customers (primarily water and wastewater systems) in operation.

Issues Impacting Product Price

The price of chlorine products has been significantly impacted by the production capacity issues described in the previous section. Additional factors that have contributed to the price increases include increases in the cost of production and transportation as well as inflationary pressures. The increased cost of production has largely been caused by significant increases in energy costs (Note: the chlor-alkali process used to produce chlorine gas and sodium hydroxide is energy intensive). The increased cost of transportation, largely due to a shortage of truck drivers, increased gas prices, and congested railways, has impacted the chemical sector as it has virtually every sector of the U.S. economy. Finally, inflationary pressures have increased the cost of many aspects of chlorine production, including the cost of raw materials, equipment, and labor.

Increased costs incurred by manufacturers are passed down to suppliers, who then pass the costs down to their customers. Additionally, suppliers incur increased costs of their own due to increased transportation costs and inflationary pressures. These costs may be passed to the customer, though some suppliers have opted to absorb them.

Outlook for Water and Wastewater Systems

The decreased production capacity of chlorine products has tightened the market for these products and made it susceptible to regional shortages. This is unlikely to change in the foreseeable future. Additionally, a proposed ban on asbestos diaphragms3 that are used to produce chorine under the Toxic Substances Control Act (TSCA) could impact approximately 30% of domestic chlorine production capacity.

Water and wastewater systems are likely to see continued increases in the price of chlorine products, perhaps as frequently as on a quarterly basis, through the end of 2022, and potentially beyond. Factors that could influence future pricing include energy prices, transportation prices, and inflation rates. Furthermore, conversion of existing chlorine manufacturing facilities that currently use asbestos diaphragms would be expensive, and the cost of conversion could be passed on to customers, including drinking water and wastewater systems.

Approaches for Preparing for Future Supply Shortages and Price Increases

The following are approaches for water and wastewater systems to prepare for future chlorine product shortages:

- Establish a contract with your primary supplier. If your utility has not established a contract to procure chlorine products, consider doing so. Establishing contracts with suppliers can ensure that your utility’s orders are prioritized during a shortage. In past supply chain disruptions, those without a contractual relationship are often the first customers to lose supply in favor of customers with a contract.

- Establish a contract with alternate suppliers. Identify alternate suppliers that could provide chlorine products. Contact the supplier’s sales representative that works in your region to discuss the possibility of establishing a contract for chlorine products and/or placing emergency orders in the future. Establishing contracts with multiple suppliers can enhance your utility’s ability to obtain chlorine products during any future supply shortages. Use the Chemical Suppliers and Manufacturers Locator Tool to identify alternate suppliers in your region.

- Identify mutual aid and assistance contacts. Join your state’s Water and Wastewater Agency Response Network (WARN) and other mutual aid networks, as well as identify nearby water systems that could assist with future shortages of chlorine products.

- Identify response partners that could provide technical assistance. Identify circuit riders and regional and/or state drinking water offices that may be able to provide local technical assistance for responding to supply issues, especially those at small systems.

- Consult your state primacy agency. Contact your state primacy agency to discuss steps that could be taken (e.g., temporary use of an alternate chemical, use of an alternate chemical grade, adjustment of chemical dosing) to respond to emergencies related to chemical shortages while maintaining compliance with drinking water standards or discharge permits.

Utilities should consider adopting a quarterly bid process for chlorine products to ensure that prices accurately reflect the market at the time of procurement, since suppliers are having difficulty projecting future pricing levels over longer periods of time. If there are concerns over unfair business practices, a claim could be filed with the Federal Trade Commission, which could then open an investigation. Furthermore, many states have anti-price-gouging laws that could be exercised if there is evidence the price gouging is occurring.

3 https://www.epa.gov/asbestos/epa-actions-protect-public-exposure-asbestos